-40%

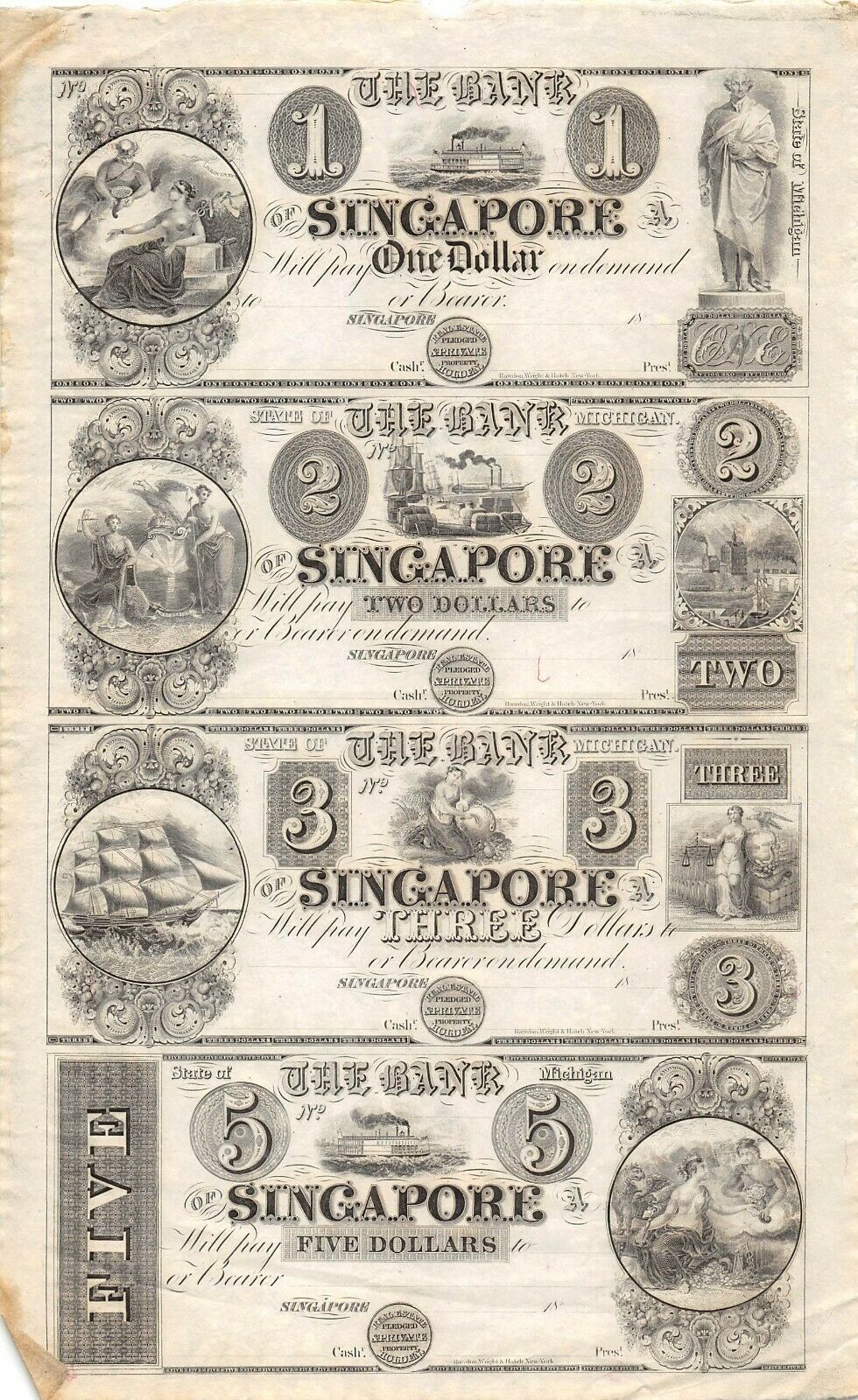

1830's Bank Of Singapore Michigan 4 Note Uncut Sheet. ---

$ 421.87

- Description

- Size Guide

Description

1830's e Bank Of Singapore Michigan 4 Note Uncut Sheet. ///"A Little Piece of History"

SINGAPORE, MICHIGAN OBSOLETE BANK NOTES

Around 175 years ago, there was a town on the eastern shores of Lake Michigan near what is now Saugatuck, Michigan called Singapore. The city was located in the southwestern part of the State of Michigan. This section of the state turned out to be one of the first areas settled. The area had promise for exploitation of the lumber located in the area and later for shipbuilding and trading with other cities located on the Great Lakes.

In 1820, Lewis Cass is believed to have traveled near there while he was exploring the Great Lakes and possibly the Mississippi River area. Also doing business was Gordon Hubbard, an employee of fur trader John Jacob Astor fame. Up to that time, it seems only fur traders were visiting the area which was inhabited by Ottawa Indians.

Around 1830, the first settling family of William Butler arrived.

The area was surveyed in 1831, noting numerous Sand Banks and a number of various trees. A large part of the property was purchased by Horace Comstock. Mr. Comstock and another early settler by the name of Stephen Nichols felt a warehouse and pier were needed to support the arrival of goods and household effects of new arrivals.

In 1836, Oshea Wilder, who had previously visited the area, and four other men agreed to invest in the states of Michigan, Illinois and Wisconsin Territory and in Indiana. It was agreed that Mr. Wilder would be allowed to purchase land as appropriate for investment purposes. Mr. Wilder noted the Singapore site would be well suited for the building of a saw mill. By December of 1836, Mr. Wilder had purchased the necessary land which included the Village of Singapore and in the beginning of 1837 had contracts let to build a scow and boats, along with contracts for a saw mill and housing for the workmen.

Mr. Wilder noted that money was rather scarce, but real estate continued to advance and the general prosperity continued. During 1837, development within Singapore continued.

In 1837, the State of Michigan passed a general banking law that permitted any ten or more freeholders of any county to organize themselves into a corporation for the transaction of banking business, with a capital of not less than ,000, nor more than 0,000. These banks were empowered to print an issue their own paper money. The act further provided that no bank should commence operation until 30% of the stock should be actually paid in, in specie or hard money, (defined in the act as gold coins, but usually gold in any form and many silver coins were considered acceptable). In the original act, the issuing Bank was required to redeem its banknotes and hard money on demand, or within 30 days thereafter. Failure to do so would result in dissolution of the bank.

As luck would have it, and before any new banks had completed the chartering process, the Financial Panic of 1837 started, and the subsequent run on banks, caused banks in New York, Philadelphia, Boston and Baltimore to suspend specie payment and redemption of banknotes. Fearing that depositors, thwarted in other states, might flood the banks of Michigan with otherwise worthless paper money, the Michigan Legislature, in a special session in June of 1837 also suspended the specie redemption requirement. Surprisingly, the lawmakers left the general banking laws in force. New banks could continue to be organized and allowed to start the business of issuing bills while the requirements to redeem them were still in a state of suspension. AMAZING!!

These new banking institutions would later be called "WILDCAT" banks because these banks were as hard to find in the woods of Michigan as the alleged elusive wildcat! Thus, if the main office for the bank that was required to redeem its money was located in some far off and/or inaccessible place, the paper money that was issued by the bank could then be circulated in the far reaches of the state, and the East coast and as a result the money would be less likely to be presented to the issuing bank for redemption. One story that was passed down alleged that there was one bank found located in a saw mill, and another located in a hollowed out tree stump!

When the banking law was passed, Oshea Wilder was quick to act on behalf of the city of Singapore. First he tried to get his investors from the East involved, but they were not very keen on the idea. As a result, Mr. Wilder, turned to James Carter, a distant relative of his who lived in Leominster, Mass. The official organizers of the Singapore bank were all residents, as the new law required, and application was dated October 5, 1837. Mr. Wilder made application to the county clerk of Allegan to have the books open for the subscription of the capital stock of an institution to be located in the village of Singapore, County of Allegan, with a capital stock of ,000.

Daniel S. Wilder, the son of Oshea, was named president of the bank, and Rob Hill, was to serve as cashier. The bank was located first in a boarding house, and then moved to a separate building. Records around that time show pressed brick was ordered and shipped from Boston for the construction of a vault.

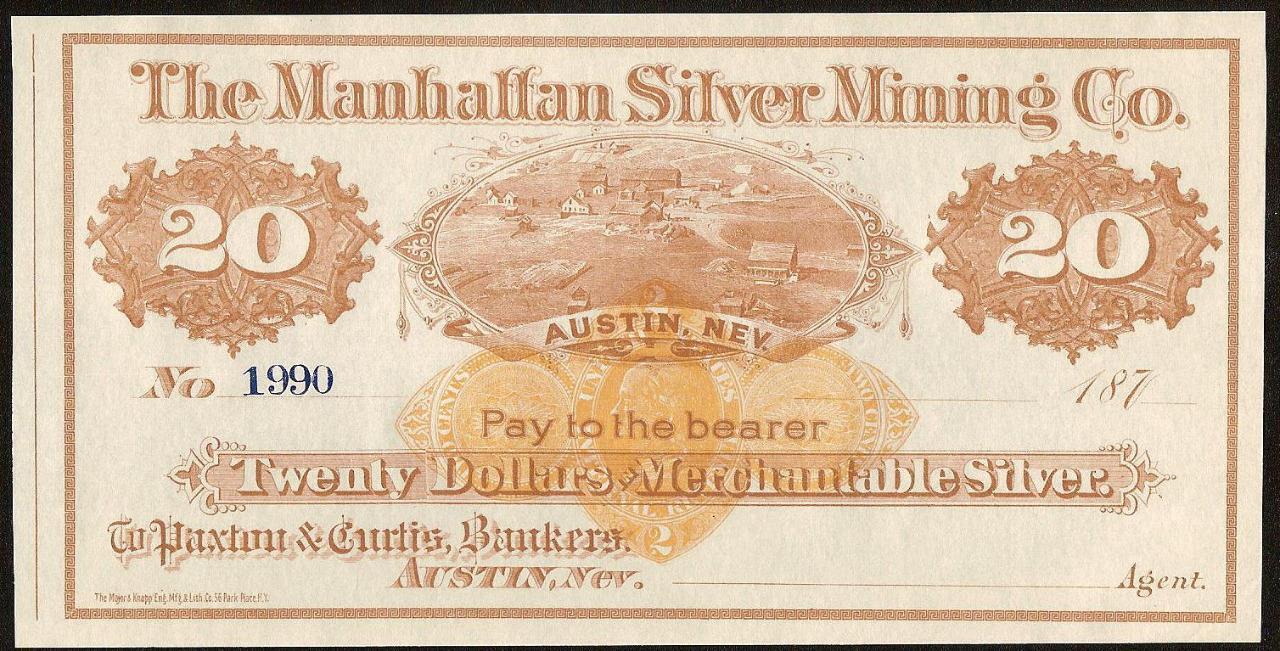

According to Harold L. Bowen in his book of 1956 titled "State Bank Notes of Michigan", ornate bills were printed by Rawdon, Wright and Hatch, a New York engraving firm, in one, two, three and five dollar denominations on each printed sheet for a total of per sheet. There were 5,000 sheets printed for a total face value of ,000. The bills, printed on one side only, were struck on a single sheet and then cut apart and signed by the cashier and president prior to be placed in circulation. Of the ,000, records show that banknotes valued at only ,952 were actually put in circulation during the bank's short existence. (If you assume the ,952 figure to be correct, and each sheet was worth , this would break down to roughly 1,450 of each note issued.).

There should have been ,000 of hard money or specie reserve. All reports indicate that this was not likely.

Several things are worth noting regarding these notes.

1. These bills are hard to locate, especially in decent condition.

2. They should be signed in and around the end of 1837 and early 1838. Note the bank went out of business in April of 1838 due to the suspension of the State of Michigan General Banking Law.

3. The signatures likely to be found would be Rob Hill, the Cashier and D. S. Wilder, the president. Other signatures should be questioned.

4. Printing was done only on the obverse.

5. The paper upon which the notes were printed is very thin and very susceptible to wear.

6. Based on Dr. James A. Haxby's four volume book titled Standard Catalog of United States Obsolete Bank Notes 1782-1866, we note concerning the cataloging of these notes that the title of the Singapore notes is "MI-420 Bank of Singapore, 1837-39". The note is numbered G2. The note is numbered G4. The note is numbered G6. The note is numbered G8.

7. Uncut sheets can be found (likely not signed), of the four notes of Singapore which Dr. Haxby catalogues as X1.

In December of 1837, the state of Michigan Legislature sought to curb the worst abuse by appointing three bank inspectors, who would inspect every bank at least once every three months. Noted in the records of the inspectors in 1838, that "the singular spectacle was presented of the officers of the state seeking for banks in situations the most inaccessible and remote from trade, and finding at every step an increase of labor by the discovery of new and unknown organizations. Before they could be arrested the mischief was done."

SPECIE OR NO SPECIE – THAT IS THE QUESTION

A major concern at this time was whether the Singapore Bank as well as other banks in the area had adequate specie or "hard money" to back up the notes that were issued. Because of this, it was not hard to run across "business relationships" that developed between individuals around Singapore and in the town of Allegan, around 25 miles away.

Relationships between the Allegan Company, The Boston Company and the Singapore City Company are noted. Because of these relationships, the grouping together for everybody's benefit was apparent, especially as it related to banking in the area. The Bank of Allegan and the Bank of Singapore and likely others, would pool their specie to create an adequate amount to please the inspectors as they did their audits of the banks.

In a history of Allegan County in the 1880's, a visit by one of the inspectors was noted as follows: "just before the day appointed for that event the president of the Allegan Bank, knowing that two of his neighbors had a considerable sum and gold coin, designed for the entry of lands, effected a temporary loan of the gold and placed it among the banks assets. It was counted by the Commissioner and with great complacency the succeeding night, and the same gold preceded him to the Bank of Singapore, at the mouth of the Kalamazoo, where the official also counted it as part of the assets of that bank."

ANOTHER PASSED DOWN THEORY OF SPECIE VALIDATION

As noted in Kit Lane's book titled "Buried Singapore: Michigan's Imaginary Pompeii", there is one of the great legends of Allegan County (which continues to this day), and which is based on some facts, but likely embellished over time, concerns the day that the pooled bank specie was being conveyed down the Kalamazoo River. It had been viewed by the bank inspector at the Bank of Allegan and was entrusted to a local Indian (probably Maksaube, an Ottawa Indian who had saved Alexander Ely from a near frozen river in 1834). Paddling swiftly to beat the bank inspector who was traveling by horseback, the canoe was just upstream from Saugatuck when it hit an obstacle in the river and capsized. The bag of gold sank to the bottom in a particularly deep part of the river. The Indian rushed ahead to Singapore and told his story. While James Harris, the village blacksmith, devised a drag hook to get the gold from the bottom of the river, word was sent back to Richmond (a nearby village) to intercept the inspector, as he would have paused there to cross the river. There was no bridge at that location yet, but there was a ferry for foot traffic. The inspector's horse would have to wade or swim.

As to Richmond, which was onn the north bank of the Kalamazoo River, and was about opposite the present day settlement of the village of New Richmond, there was a small sawmill community under construction in 1838. It had been established by John Allen, founder of Ann Arbor, and a number of Eastern investors in late 1835 and early 1836. Two of the first men on the scene were Jonathan F. Stratton, who had contracted with Allen to grub a mill race and Ralph R. Mann, who first signed (and later backed out of) a contract to build the first mill. Stratton's contract also gave him permission "to erect and build at his own proper cost and expense at Richmond, a large two-story public house for the accommodation of travelers."

In 1837, Charles Moseley, one of the investors in the project, visited the settlement and noted that Stratton had already cut timber for his tavern house, and that Mann, who was not a great favorite of his, had been appointed Justice of the Peace "and will be a nuisance to our village. He calculated to keep a tavern, sell whiskey and do anything that a lazy unprincipled man can devise to make a sixpence…." He later reported that Mann "has already begun to keep whiskey and uses it freely himself."

It was at this settlement that word was sent from Singapore asking either Mann or Stratton to delay the inspector long enough to give the Singapore men time to recover the gold. The inspector was invited for a drink, perhaps even a meal; maybe a party and a night's lodging. Downstream using the blacksmith's hook on the end of a dragging rope, the gold was recovered and sent to the bank to dry out a bit. Word was then sent back to Richmond that the inspector could proceed. Shortly afterwards, or perhaps the next day, the inspector and the specie met again at the Singapore Bank.

The story has been told and retold over the years. In 1898, when Mr. Henry Hudson Hutchings interviewed the old-timers of the area and compiled their memories into a series of newspaper articles, the basic facts were upheld by John P. Wade who had come to Singapore in 1844 and R. Wadsworth who settled in nearby Ganges Township in 1840, and had heard it from the earliest settlers in the area. For many years a set of drag hooks, said to be the very ones that recovered the gold from the river, were on display in the nearby Saugatuck village hall.

A THIRD NARRATIVE USING QUESTIONABLE SINGAPORE CURRENCY

There is another interesting story as to use of the Singapore notes by one Levi Loomis, who was believed to be one of the first settlers in the Singapore area.

During the late 1830's, there seems to have been a shortage of footwear in the area. Mr. Loomis noted this and thought he had a solution to the problem. He wanted to order footwear from the east, and when received would try to sell them locally. When the locals tried to buy the footwear, they presented Mr. Loomis with Bank of Singapore notes, which, as it turned out, Mr. Loomis refused to accept.

Because the locals also knew the people who ran the bank, and the fact that the bank of Singapore wanted to try and please its customers, the bank worked out an arrangement whereby it agreed it would redeem the Singapore bills with bills from the east and would do so in time to enable Mr. Loomis to pay timely the invoices for the footwear. Mr. Loomis agreed to this arrangement and it is believed he sold his stock of footwear for the sum of 0.

As one could imagine, when the time for the redemption came due, the Bank of Singapore started to look for ways to delay this process. The bank first tried to make a draft on one of the Eastern banks, but it came back worthless. This continued for another month, and Mr. Loomis was getting worried. After all, Mr. Loomis had his credit and reputation at stake and as the delays continued he felt he needed to take desperate measures.

Mr. Loomis is thought to have rented a room to the Bank of Singapore's cashier, Mr. Rob Hill. Mr. Loomis suspected that Mr. Hill had with him the real specie of the bank and kept it in his room. When Mr. Loomis was sure no one else was around, he went to the room of Mr. Hill, who was sleeping at the time, and woke him up and dumped the worthless bills on top of Mr. Hill's mattress. Mr. Loomis, who had a pistol, pointed it toward Mr. Hill and demanded Mr. Hill trade him good money for the bad.

Mr. Hill it is claimed, was taken by surprise and tried to stall, but Mr. Loomis would have nothing of it. Mr. Loomis would not allow Mr. Hill to leave the room until the exchange was made. As a result, it is believed Mr. Hill, taking Mr. Loomis's threat seriously, went over to his bed, lifted up his pillow, under which there is claimed to have been a roll of ,000 of real bank money, and traded the Singapore money with the "good" bank money.

It should be noted the during this whole time, the currency issued by the Singapore Bank was never really accepted by the people or the merchants. Its actual circulation was believed to be small and short lived. Thus, little was ever issued, and even less ever survived!!!

THE SUSPENSION OF THE STATE OF MICHIGAN BANKING LAWS

The State of Michigan General Banking laws turned out to be of a short duration. The state suspended the law on April 3, 1838. With this suspension, these "wildcat" banks were put out of business.

The Bank of Singapore was no exception. In 1839, the bank did attempt to reorganize, however, after a state of Michigan bank commissioners' visit, the operations ceased.

The charter of the bank was annulled by the state legislature on February 16, 1842 along with a number of the other wildcat banks.

It is claimed that during this time, Mr. Loomis was visiting at the home of one of the former bank officers on a cold winter evening. This visit is purported to have taken place to see the burning and destruction of the Singapore bank notes that were still on hand at the time of the suspension. The claim was made that there was a table covered with the bills of the bank alleged to be in three to six inch piles. It was stated that these bills were burned in a stove at that time.

The bank building was later used as a general store and then physically moved later on to the village of Saugatuck.

The city of Singapore continued on for a number of years until the lumber ran out in the later part of the 19th century. The lumber was used to help rebuild the city of Chicago after the great Chicago fire as well as other cities also destroyed by fire in the area.

WHAT ONCE WAS, IS NO MORE

Once the lumber ran out, the people moved on to other areas. The city of Singapore ceased to exist and was abandoned and became a ghost town. Today, there is little in the way of physical evidence left due to the city being covered by the shifting sand dunes that still exist to this day. Unless you are aware of the prior history, the average citizen to the area today, would have no idea that a once bustling city existed in that north side location at the mouth of the Kalamazoo River!! The only real physical evidence existing today are those few obsolete bank notes collected by savy collectors, which continues to tell part of the story of the ghost town of Singapore.